Buying a home is often described as one of the happiest milestones of life, and rightly so. A home represents stability, emotional security, and long-term wealth creation. However, while most homebuyers focus heavily on the property’s price and loan eligibility, very few are truly prepared for the hidden costs that quietly creep in before, during, and even long after the purchase is complete.

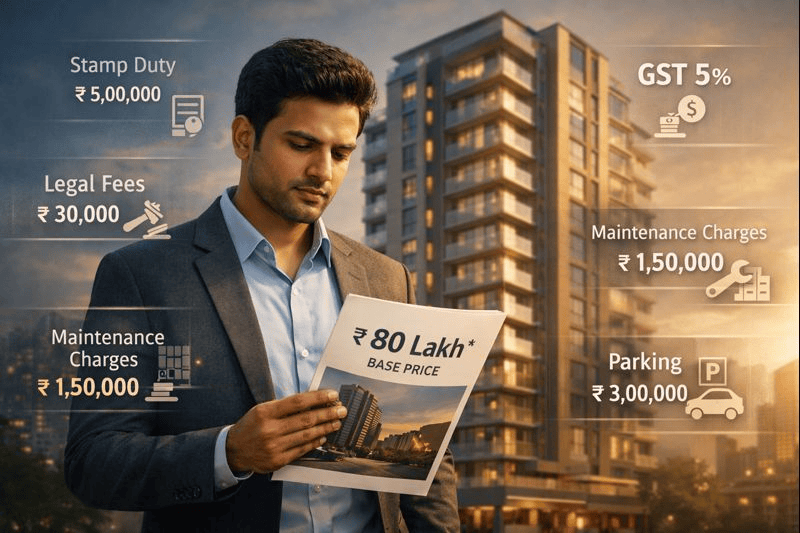

These costs are rarely highlighted by advertisements or sales conversations. They don’t show up clearly on brochures, and many first-time buyers only discover them once they are already financially committed. From government levies and legal expenses to maintenance charges and post-possession costs, these “invisible expenses” can collectively add several lakhs to your total outflow.

This is exactly why informed decision-making is crucial. At Housiey, we believe transparency is not optional—it’s essential. By connecting homebuyers directly with verified builders and providing complete cost clarity, Housiey ensures you don’t walk into surprises that strain your finances later.

In this detailed guide, we uncover the hidden costs of buying a home nobody tells you about, explain why they matter, and show how you can plan better and smarter, before signing on the dotted line.

Also Check:- How to Verify Builder Credibility in 10 Minutes

Stamp Duty & Registration Charges – The First Big Shock

Most buyers mentally prepare for the down payment but underestimate how high stamp duty and registration charges can be. These are mandatory government charges and must be paid upfront at the time of property registration.

Stamp duty rates vary from state to state and typically range between 5% to 7% of the property’s agreement value, while registration charges add another 1% approximately. Importantly, banks do not finance these costs under home loans, meaning they come straight out of your pocket.

Many buyers realize too late that this alone can add ₹5–10 lakhs to their initial payment burden, especially in metro cities.

GST on Under-Construction Properties – Often Overlooked

If you’re buying an under-construction property, Goods and Services Tax (GST) is applicable. While ready-to-move homes are exempt, under-construction homes attract GST at 1% for affordable housing and 5% for non-affordable housing, without input tax credit.

This cost is frequently downplayed during discussions and is sometimes not clearly mentioned in marketing material. Since GST is calculated on the base value of the property, it can significantly increase the total cost.

Platforms like Housiey clearly disclose GST applicability upfront, ensuring buyers understand whether their selected project includes this tax or not.

Also Check:- What Is GST on Under‑Construction Property?

Legal Fees & Documentation Charges – Small but Necessary

Buying a home involves extensive legal paperwork—sale agreements, title verification, loan agreements, and registration documentation. Hiring a competent property lawyer is not optional if you want peace of mind.

Legal fees typically range from ₹20,000 to ₹1,00,000, depending on the city and complexity of the transaction. While this may seem small compared to the property price, skipping legal due diligence can lead to far costlier problems later.

Home Loan Processing Fees & Bank Charges

When opting for a home loan, buyers often focus only on interest rates. However, banks charge a processing fee, generally between 0.25% to 1% of the loan amount, along with administrative and technical valuation charges.

In addition, there may be legal verification fees, MOD charges, and document handling costs that add to the total expense. These are usually deducted upfront or paid before loan disbursement.

Housiey helps buyers connect with trusted financial partners who clearly explain all loan-related charges in advance.

Also Check:- Home Loan Foreclosure Charges & Rules, Benefits

Maintenance Deposits & Society Charges

Builders typically collect maintenance deposits or corpus funds at the time of possession. These are meant to cover future society expenses such as security, lifts, common lighting, and clubhouse upkeep.

This one-time cost can range anywhere from ₹50,000 to ₹3 lakhs, depending on the project’s scale and amenities. Many buyers mistake this as a refundable amount, which is not always the case.

Parking Charges – Not Always Included

Contrary to popular belief, parking is not always bundled with the apartment cost. Builders may charge separately for covered or podium parking spaces.

In metro cities, parking costs can go up to ₹3–6 lakhs, especially in premium developments. If you require multiple parking slots, this cost multiplies quickly.

Interior Work & Customization Costs

A bare-shell or semi-finished apartment might look affordable initially, but the real expenses begin once possession is handed over. Modular kitchens, wardrobes, lighting, curtains, false ceilings, and air conditioning installations add up fast.

Interior costs can easily range between ₹5–15 lakhs, depending on size and quality preferences. These expenses are rarely factored into the initial budget planning.

Utility Connection Charges & Meter Deposits

Electricity meter installation, water connection charges, gas pipeline deposits, and sewage connection fees are often billed separately.

While each charge might seem minor, together they can total ₹25,000–₹75,000, especially in newly developed projects.

Property Tax & Municipal Levies

Once you become a homeowner, the annual property tax becomes your responsibility. This tax varies by location, property size, and municipal rules.

Additionally, there may be local levies such as water tax, garbage tax, and infrastructure cess that buyers are unaware of at the time of purchase.

Home Insurance – Smart but Optional Cost

While not mandatory, home insurance is strongly recommended and sometimes required by lenders. It protects your home structure and contents against natural disasters, fire, and other risks.

Premiums vary based on coverage but add to recurring annual costs that buyers often forget to account for.

Clubhouse Membership & Amenity Charges

Many premium projects charge a one-time clubhouse or amenity access fee. This covers gyms, swimming pools, sports courts, and recreational areas.

These charges can range from ₹50,000 to ₹2 lakhs, depending on the project and lifestyle offering.

Moving & Setup Expenses

Shifting costs, temporary rentals, storage charges, and basic setup expenses (internet, furniture movement, cleaning) can quietly stretch your budget.

Though not technically part of the property cost, these are unavoidable expenses tied directly to buying a home.

Hidden Cost Summary Table

| Hidden Cost Component |

Approximate Cost Range |

| Stamp Duty & Registration |

6%–8% of property value |

| GST (Under-Construction) |

1%–5% |

| Legal Fees |

₹20,000 – ₹1,00,000 |

| Loan Processing Charges |

0.25%–1% of loan |

| Maintenance Deposit |

₹50,000 – ₹3,00,000 |

| Parking Charges |

₹1,50,000 – ₹6,00,000 |

| Interior & Setup |

₹5,00,000 – ₹15,00,000 |

| Utility & Meter Charges |

₹25,000 – ₹75,000 |

How Housiey Protects You from These Hidden Costs

At Housiey, transparency is not a feature, it’s the foundation. Unlike traditional property platforms that circulate your contact details to multiple brokers, Housiey connects you directly with verified builders, ensuring clear communication and zero confusion.

Housiey provides:

- Complete cost breakdowns upfront

- Builder-verified pricing with no hidden surprises

- Direct access without broker interference

- Expert guidance at every stage of the buying journey

When you buy through Housiey, you don’t just buy a home—you buy clarity, confidence, and control.

Also Read:- Common Real Estate Fraud and How to Avoid Them

Conclusion: A Home Should Bring Joy, Not Financial Stress

Buying a home is an emotional and financial commitment that should be handled with foresight, not assumptions. Hidden costs can silently derail your budget, delay your plans, and create unnecessary stress if you’re unprepared.

The smartest homebuyers are not those who find the cheapest property, but those who understand the true cost of ownership. By planning ahead and choosing transparent platforms like Housiey, you ensure your dream home remains a source of happiness, not regret.

If you’re serious about buying smart, buying safe, and buying transparent, Housiey is where your journey should begin.

FAQs

Buying a home is often described as one of the happiest milestones of life, and rightly so. A home represents stability, emotional security, and long-term wealth creation. However, while most homebuyers focus heavily on the property’s price and loan eligibility, very few are truly prepared for the hidden costs that quietly creep in before, during, and even long after the purchase is complete.

These costs are rarely highlighted by advertisements or sales conversations. They don’t show up clearly on brochures, and many first-time buyers only discover them once they are already financially committed. From government levies and legal expenses to maintenance charges and post-possession costs, these “invisible expenses” can collectively add several lakhs to your total outflow.

This is exactly why informed decision-making is crucial. At Housiey, we believe transparency is not optional—it’s essential. By connecting homebuyers directly with verified builders and providing complete cost clarity, Housiey ensures you don’t walk into surprises that strain your finances later.

In this detailed guide, we uncover the hidden costs of buying a home nobody tells you about, explain why they matter, and show how you can plan better and smarter, before signing on the dotted line.

Also Check:- How to Verify Builder Credibility in 10 Minutes

Stamp Duty & Registration Charges – The First Big Shock

Most buyers mentally prepare for the down payment but underestimate how high stamp duty and registration charges can be. These are mandatory government charges and must be paid upfront at the time of property registration.

Stamp duty rates vary from state to state and typically range between 5% to 7% of the property’s agreement value, while registration charges add another 1% approximately. Importantly, banks do not finance these costs under home loans, meaning they come straight out of your pocket.

Many buyers realize too late that this alone can add ₹5–10 lakhs to their initial payment burden, especially in metro cities.

GST on Under-Construction Properties – Often Overlooked

If you’re buying an under-construction property, Goods and Services Tax (GST) is applicable. While ready-to-move homes are exempt, under-construction homes attract GST at 1% for affordable housing and 5% for non-affordable housing, without input tax credit.

This cost is frequently downplayed during discussions and is sometimes not clearly mentioned in marketing material. Since GST is calculated on the base value of the property, it can significantly increase the total cost.

Platforms like Housiey clearly disclose GST applicability upfront, ensuring buyers understand whether their selected project includes this tax or not.

Also Check:- What Is GST on Under‑Construction Property?

Legal Fees & Documentation Charges – Small but Necessary

Buying a home involves extensive legal paperwork—sale agreements, title verification, loan agreements, and registration documentation. Hiring a competent property lawyer is not optional if you want peace of mind.

Legal fees typically range from ₹20,000 to ₹1,00,000, depending on the city and complexity of the transaction. While this may seem small compared to the property price, skipping legal due diligence can lead to far costlier problems later.

Home Loan Processing Fees & Bank Charges

When opting for a home loan, buyers often focus only on interest rates. However, banks charge a processing fee, generally between 0.25% to 1% of the loan amount, along with administrative and technical valuation charges.

In addition, there may be legal verification fees, MOD charges, and document handling costs that add to the total expense. These are usually deducted upfront or paid before loan disbursement.

Housiey helps buyers connect with trusted financial partners who clearly explain all loan-related charges in advance.

Also Check:- Home Loan Foreclosure Charges & Rules, Benefits

Maintenance Deposits & Society Charges

Builders typically collect maintenance deposits or corpus funds at the time of possession. These are meant to cover future society expenses such as security, lifts, common lighting, and clubhouse upkeep.

This one-time cost can range anywhere from ₹50,000 to ₹3 lakhs, depending on the project’s scale and amenities. Many buyers mistake this as a refundable amount, which is not always the case.

Parking Charges – Not Always Included

Contrary to popular belief, parking is not always bundled with the apartment cost. Builders may charge separately for covered or podium parking spaces.

In metro cities, parking costs can go up to ₹3–6 lakhs, especially in premium developments. If you require multiple parking slots, this cost multiplies quickly.

Interior Work & Customization Costs

A bare-shell or semi-finished apartment might look affordable initially, but the real expenses begin once possession is handed over. Modular kitchens, wardrobes, lighting, curtains, false ceilings, and air conditioning installations add up fast.

Interior costs can easily range between ₹5–15 lakhs, depending on size and quality preferences. These expenses are rarely factored into the initial budget planning.

Utility Connection Charges & Meter Deposits

Electricity meter installation, water connection charges, gas pipeline deposits, and sewage connection fees are often billed separately.

While each charge might seem minor, together they can total ₹25,000–₹75,000, especially in newly developed projects.

Property Tax & Municipal Levies

Once you become a homeowner, the annual property tax becomes your responsibility. This tax varies by location, property size, and municipal rules.

Additionally, there may be local levies such as water tax, garbage tax, and infrastructure cess that buyers are unaware of at the time of purchase.

Home Insurance – Smart but Optional Cost

While not mandatory, home insurance is strongly recommended and sometimes required by lenders. It protects your home structure and contents against natural disasters, fire, and other risks.

Premiums vary based on coverage but add to recurring annual costs that buyers often forget to account for.

Clubhouse Membership & Amenity Charges

Many premium projects charge a one-time clubhouse or amenity access fee. This covers gyms, swimming pools, sports courts, and recreational areas.

These charges can range from ₹50,000 to ₹2 lakhs, depending on the project and lifestyle offering.

Moving & Setup Expenses

Shifting costs, temporary rentals, storage charges, and basic setup expenses (internet, furniture movement, cleaning) can quietly stretch your budget.

Though not technically part of the property cost, these are unavoidable expenses tied directly to buying a home.

Hidden Cost Summary Table

| Hidden Cost Component |

Approximate Cost Range |

| Stamp Duty & Registration |

6%–8% of property value |

| GST (Under-Construction) |

1%–5% |

| Legal Fees |

₹20,000 – ₹1,00,000 |

| Loan Processing Charges |

0.25%–1% of loan |

| Maintenance Deposit |

₹50,000 – ₹3,00,000 |

| Parking Charges |

₹1,50,000 – ₹6,00,000 |

| Interior & Setup |

₹5,00,000 – ₹15,00,000 |

| Utility & Meter Charges |

₹25,000 – ₹75,000 |

How Housiey Protects You from These Hidden Costs

At Housiey, transparency is not a feature, it’s the foundation. Unlike traditional property platforms that circulate your contact details to multiple brokers, Housiey connects you directly with verified builders, ensuring clear communication and zero confusion.

Housiey provides:

- Complete cost breakdowns upfront

- Builder-verified pricing with no hidden surprises

- Direct access without broker interference

- Expert guidance at every stage of the buying journey

When you buy through Housiey, you don’t just buy a home—you buy clarity, confidence, and control.

Also Read:- Common Real Estate Fraud and How to Avoid Them

Conclusion: A Home Should Bring Joy, Not Financial Stress

Buying a home is an emotional and financial commitment that should be handled with foresight, not assumptions. Hidden costs can silently derail your budget, delay your plans, and create unnecessary stress if you’re unprepared.

The smartest homebuyers are not those who find the cheapest property, but those who understand the true cost of ownership. By planning ahead and choosing transparent platforms like Housiey, you ensure your dream home remains a source of happiness, not regret.

If you’re serious about buying smart, buying safe, and buying transparent, Housiey is where your journey should begin.

FAQs