Paying property tax can often be a hassle, involving long queues and tedious paperwork. However, the Vapi Nagarpalika has streamlined this process by offering convenient online and offline payment options, making it easier for residents to fulfill their tax obligations. In this comprehensive guide, we’ll walk you through everything you need to know about paying your Vapi Nagarpalika property tax. This includes detailed steps for both online and offline payment methods, information on available rebates, and important dates you should mark on your calendar to avoid any late fees or penalties. With this guide, you can ensure a smooth and hassle-free property tax payment experience.

Also Read:- The Importance Of 7/12 Utara: A Complete Overview For Property Owners

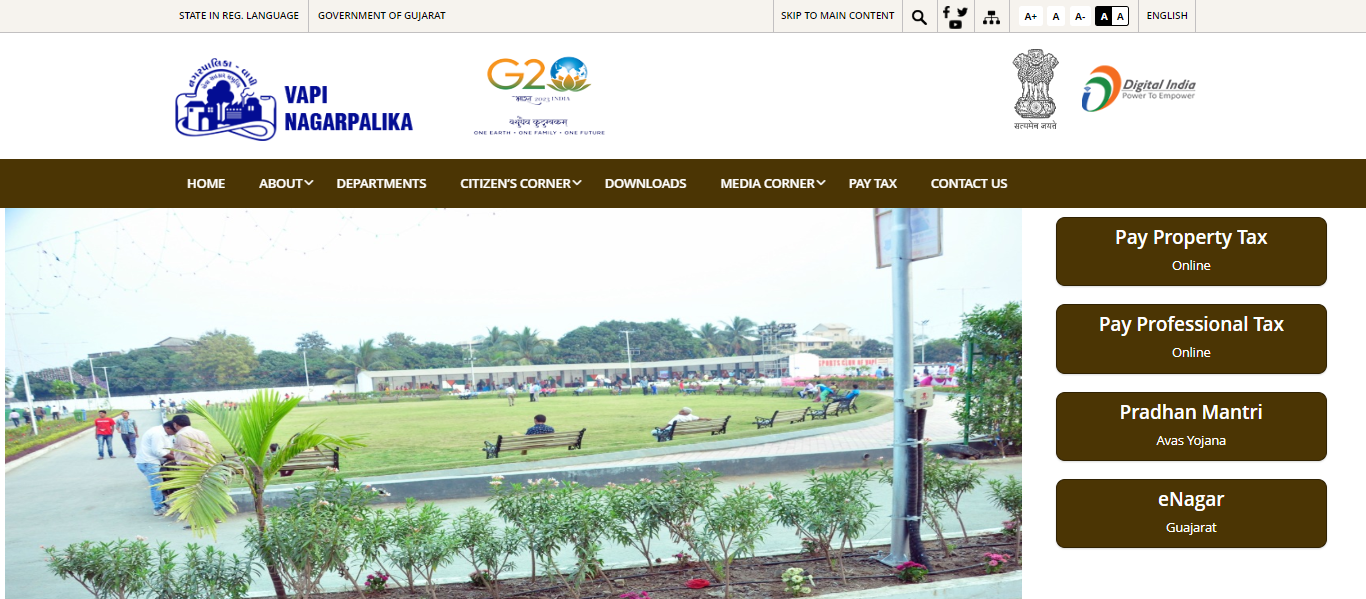

Vapi Nagarpalika

Vapi is a bustling city located in the Valsad district of Gujarat, India. Known for its industrial growth and strategic location near the Maharashtra border, Vapi has become a significant hub for commerce and industry. The Vapi Nagarpalika, also known as the Vapi Municipality, plays a pivotal role in the city’s development and administration. This governing body is responsible for providing a wide range of civic amenities to its residents, including water supply, sanitation, road maintenance, and waste management. Additionally, the Vapi Nagarpalika oversees infrastructure development projects that enhance the quality of life in the city. One of its critical functions is the collection of property taxes, which serve as a major source of revenue for funding these essential services and development initiatives.

Vapi Nagarpalika Property Tax

Vapi Nagarpalika property tax is a tax levied on property owners by the municipality. This tax is used for the maintenance and development of local infrastructure such as roads, parks, and public utilities.

Vapi Nagarpalika Property Tax Online

Paying your Vapi Nagarpalika property tax online is a convenient and efficient way to fulfill your tax obligations. Follow these steps to make your payment online:

Visit the official website of Vapi Nagarpalika.

Image: vapimunicipality.com

Also Read:- Will Union Budget 2024 Boost Affordable Home Buying?

Navigate to the property tax payment section.

Image: vapimunicipality.com

Enter your property details, such as the property ID or account number.

Image: vapimunicipality.com

Verify the tax amount due and click on Search.

Image: vapimunicipality.com

- Select the payment method and proceed with the payment.

- After successful payment, a confirmation message will be displayed.

Vapi Nagarpalika Property Tax Offline

If you prefer to pay your Vapi Nagarpalika property tax offline, you can visit the municipal office or designated banks. Here’s how you can do it:

- Visit the Vapi Nagarpalika office or designated bank.

- Fill out the property tax payment form with the required details.

- Submit the form along with the payment (cash, cheque, or demand draft).

- Collect the payment receipt for your records.

Image: Vapi Nagarpalika Offline form

Also Read:- Things To Check Before Buying A Flat In Mumbai 2024

Vapi Nagarpalika Property Tax Rebate

Property owners in Vapi should be diligent about paying their property taxes on time. Failure to do so results in a penalty, adding an extra financial burden. However, there’s a silver lining for those who are punctual. Paying your Vapi Nagarpalika property tax on time not only helps you avoid penalties but also makes you eligible for a rebate. The municipality offers a generous rebate of up to 10% for timely payments, providing a significant saving opportunity. This incentive encourages residents to stay ahead of their tax obligations while benefiting from the financial perks of being prompt. By paying your property tax on time, you contribute to the city’s development and enjoy monetary rewards.

Last Date to Pay Vapi Nagarpalika Property Tax

Mark your calendars! The deadline for paying your Vapi Nagarpalika property tax for the first half of the year is March 31, while the due date for the second half is typically October 15. Make sure to settle your taxes by these dates to avoid any penalties and keep your property records in good standing.

How to Download the Vapi Nagarpalika Property Tax Payment Receipt?

After making the payment, you can download the Vapi Nagarpalika property tax payment receipt online. Here’s how:

Log in to the Vapi Nagarpalika property tax payment portal.

Image: vapimunicipality.com

Navigate to the pay property section.

Image: vapimunicipality.com

Navigate the download section and select the “Payment Receipt” Option

Image: vapimunicipality.com

Enter the application number, mobile number and email ID.

Image: vapimunicipality.com

Also Read:- Top 10 Reasons To Invest In Panvel In 2024

Click on ‘Search’ to proceed.

Vapi Nagarpalika Contact Details

For any queries or assistance regarding property tax payments, you can reach out to Vapi Nagarpalika using the following contact details:

- Address: Vapi Nagarpalika Office, Near Fire Station, Vapi, Gujarat – 396191

- Phone: +91-260-2432800

- Email: info@vapimunicipality.com

- Website: www.vapimunicipality.com

By following this guide, you can easily manage your property tax payments to the Vapi Nagarpalika. Whether you choose to pay online or offline, make sure to do so before the deadline to avoid any penalties and take advantage of potential rebates.

FAQs

1. How can I pay my Vapi Nagarpalika property tax online?

- You can pay your Vapi Nagarpalika property tax online by visiting the official Vapi Nagarpalika website, navigating to the property tax payment section, entering your property details, and completing the payment using your preferred method.

2. What should I do if I miss the deadline for paying my Vapi Nagarpalika property tax?

- If you miss the deadline, you may be subject to penalties. It’s best to contact the Vapi Nagarpalika office to understand the penalty charges and make the payment as soon as possible to avoid further fees.

3. Is there a rebate for paying the Vapi Nagarpalika property tax on time?

- Yes, property owners who pay their Vapi Nagarpalika property tax on time are eligible for a rebate of up to 10%, providing a significant saving on your tax bill.

4. Where can I find the Vapi Nagarpalika property tax payment receipt after making an online payment?

- After completing your online payment, you can download your property tax payment receipt from the payment history or receipt section on the Vapi Nagarpalika property tax portal.

5. What are the Vapi Nagarpalika contact details for property tax-related queries?

- For any property tax-related queries, you can contact the Vapi Nagarpalika at:

- Address: Vapi Nagarpalika Office, Near Fire Station, Vapi, Gujarat – 396191

- Phone: +91-260-2432800

- Email: info@vapimunicipality.com

- Website: www.vapimunicipality.com