Mumbai has always been a city where real estate moves at the speed of demand. But in the last few years, one factor has started influencing property prices more consistently than anything else, Mumbai Metro.

From Andheri to Dahisar, from Ghatkopar to Chembur, and now even deeper into Navi Mumbai, metro lines are no longer “future infrastructure plans.” They are active price drivers. The moment a metro corridor is announced, property interest spikes. The moment construction begins; developers start repositioning projects. And the moment a metro station becomes operational, the locality’s real estate profile changes permanently.

In simple words, metro connectivity is no longer a luxury. It is a real estate pricing engine.

In this blog, we will break down the Mumbai metro impact on property prices, corridor by corridor. We will also understand how the metro is influencing residential, commercial, and rental markets, while highlighting the best investment corridors across Mumbai.

Why Is the Mumbai Metro Becoming a Game-Changer for Real Estate?

Mumbai is a city where commute time directly affects lifestyle, work-life balance, and even health. Historically, the city’s growth revolved around railway lines and highway corridors. But today, metro connectivity is creating a fresh map of “prime” and “upcoming” areas.

Here’s why metro connectivity is shifting real estate value:

- It reduces commute time drastically

- It increases accessibility to business hubs

- It upgrades the livability index of suburbs

- It increases buyer confidence in emerging micro-markets

- It supports higher rental demand due to easier travel

This is exactly why metro corridor real estate appreciation Mumbai has become one of the hottest topics among homebuyers and investors.

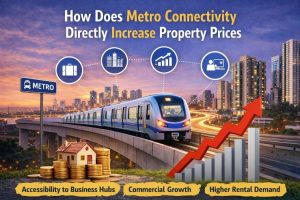

How Does Metro Connectivity Directly Increase Property Prices?

Metro impact on real estate prices is not random, it follows a pattern. The closer a property is to a metro station, the higher the demand, and eventually the higher the price.

Key reasons why metro stations boost property prices:

- Faster connectivity to business districts

- Higher rental demand from working professionals

- Better footfall and commercial activity

- Increased developer interest in redevelopment projects

- Improved perception of the locality

This is why property prices near metro stations in Mumbai have been consistently outperforming several non-metro connected pockets.

In fact, the metro is turning average suburbs into premium real estate destinations, without the need for them to be close to South Mumbai.

What Happens to Property Prices During Each Metro Development Stage?

Metro-led appreciation happens in phases, and each phase impacts buyer sentiment differently.

-

Announcement Stage: Why Does Speculation Begin Immediately?

As soon as a metro line is announced, the area starts receiving attention from:

- Investors looking for early entry

- Developers acquiring land parcels

- Homebuyers searching for affordability before rates rise

This phase triggers the earliest wave of metro-led demand for properties Mumbai.

-

Construction Stage: Why Does Demand Become Stronger?

Once construction starts, the metro becomes real. The locality gains visibility, and buyers begin taking it seriously.

At this stage, mid-level appreciation begins, especially in new launch projects.

This is where metro expansion residential price hike in Mumbai becomes visible.

-

Operational Stage: Why Does the Real Price Jump Happen?

When the metro begins operations, the demand shifts from “future potential” to “live convenience.”

This is the stage where real price growth happens because:

- Rental demand rises instantly

- Buyers start paying a premium for connectivity

- Commercial spaces gain higher footfall

This is the stage that fuels Mumbai metro lines property price growth in the strongest way.

Which Mumbai Corridors Are Seeing the Highest Metro-Based Real Estate Growth?

Not all metro corridors impact prices equally. The strongest appreciation happens where the metro connects major business hubs, airports, highways, and railway stations.

Let’s explore corridor-wise growth patterns in Mumbai.

How Is Metro Line 1 Changing Real Estate in Andheri–Ghatkopar Belt?

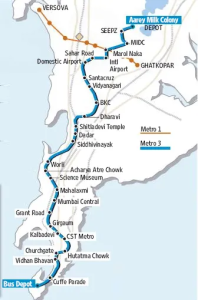

Mumbai Metro Line 1 (Versova–Andheri–Ghatkopar) is the earliest example of how metro connectivity transforms property markets.

Why is this corridor a benchmark?

Because it connects:

- Western suburbs

- Eastern suburbs

- Major corporate zones

- Residential high-density zones

What real estate changes has it created?

- Higher rental demand from office-goers

- Increased redevelopment projects in Andheri East

- Strong price appreciation in Ghatkopar and nearby pockets

This corridor clearly proves that metro connectivity real estate investment Mumbai is one of the smartest long-term strategies.

How Is Metro Line 2A Impacting Property Prices in Dahisar–Andheri Corridor?

Metro Line 2A (Dahisar East to DN Nagar) has opened a new price transformation story in Mumbai’s western belt.

Why is this corridor important?

Because it connects far-off suburbs like Dahisar and Borivali to Andheri without relying solely on highways.

Which localities are gaining the most?

- Dahisar East

- Borivali West and East

- Kandivali

- Malad

- Andheri West

Also Read:- Which Areas in Mumbai Offer the Highest ROI for Property Buyers?

What is the major impact here?

This corridor is driving:

- Increased demand for 1 BHK and 2 BHK units

- Higher interest from salaried buyers

- Rapid redevelopment of old societies

This is one of the best examples of the best suburbs, Mumbai metro property value rising steadily due to improved mobility.

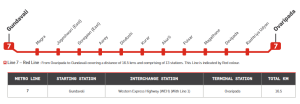

How Is Metro Line 7 Transforming Andheri East–Mira Road Market?

Metro Line 7 (Andheri East to Dahisar East) has improved connectivity for one of the most traffic-heavy stretches in Mumbai.

Why is this corridor seeing strong demand?

Because it connects:

- WEH (Western Express Highway) belt

- Business hubs in Andheri East

- Residential zones in Kandivali and Borivali

What is the real estate shift happening here?

- Andheri East is becoming more premium due to better connectivity

- Borivali and Kandivali are seeing increased new project launches

- Buyers are willing to pay extra for metro proximity

This is driving property prices near metro stations in Mumbai upward, especially around station zones.

How Is Metro Line 3 Expected to Reshape Mumbai’s Prime Real Estate Zones?

Metro Line 3 (Colaba–Bandra–SEEPZ) is arguably the most powerful metro line in Mumbai’s history. It is not just connecting suburbs, it is connecting Mumbai’s most expensive business and lifestyle zones underground.

Why is Metro Line 3 considered a real estate revolution?

Because it connects:

- Colaba and South Mumbai

- Worli

- Lower Parel

- BKC

- Airport

- MIDC

- SEEPZ

What does this mean for property rates?

This corridor will push appreciation in:

- Bandra East

- Santacruz

- Andheri East

- Worli

- Lower Parel

- Churchgate and Colaba belt

The most important impact is expected in business-driven pockets, especially where corporate demand is high.

This is why Bandra Kurla Complex metro property rates are expected to see further strengthening, as BKC becomes even more accessible.

How Is the Metro Influencing Commercial Real Estate Growth in Mumbai?

Mumbai is not only a residential market. It is also India’s commercial capital. And metro connectivity is influencing commercial real estate faster than residential.

Why does Metro boost commercial real estate?

Because commercial spaces depend on:

- Employee commute ease

- Customer footfall

- Accessibility for clients

- Connectivity to airports and railway hubs

This is why metro’s influence on commercial real estate in Mumbai is becoming a major factor in office leasing decisions.

Which commercial zones are benefiting the most?

- Andheri East (MIDC and SEEPZ)

- BKC (Bandra East)

- Lower Parel and Worli

- Ghatkopar and Chembur commercial pockets

- Navi Mumbai nodes near metro planning

The metro is making offices in suburbs more attractive, reducing pressure on traditional CBD zones.

How Is the Metro Affecting Rental Markets and Tenant Demand Across Mumbai?

One of the fastest changes caused by metro connectivity is seen in rental markets. Tenants don’t wait for years like investors do. They react immediately to convenience.

What is happening in the rental market?

- Higher demand near metro stations

- Higher rent premiums for metro-walkable societies

- Increased preference for compact units like 1 BHK and 2 BHK

This is why Mumbai metro rental market trends show consistent growth in tenant movement toward metro-connected corridors.

What is the key result?

Landlords are experiencing stronger occupancy rates and better rent negotiations, leading to improved rental yields near Mumbai metro corridors.

How Is Metro Expansion Driving Affordable Housing Demand in Outer Suburbs?

Mumbai’s central zones are expensive. The metro is allowing homebuyers to move outward without feeling disconnected.

Why are outer suburbs seeing affordable housing growth?

Because metro connectivity makes:

- Dahisar

- Mira Road belt

- Kandivali extensions

- Mulund and Bhandup belt

- Navi Mumbai nodes

feel like viable daily commute locations.

This is why affordable housing near the Mumbai metro is becoming a major trend, especially among first-time homebuyers and young couples.

The metro is helping Mumbai expand horizontally in a sustainable manner.

How Is Navi Mumbai Metro and Panvel Growth Becoming a New Investment Story?

One of the biggest upcoming transformations is happening beyond Mumbai city limits.

The metro expansion into Navi Mumbai is shaping a new market cycle, particularly in Panvel.

Why is Panvel becoming a hot real estate zone?

Because it is linked with:

- Navi Mumbai Metro plans

- Mumbai Trans Harbour Link connectivity

- Upcoming airport influence

- New infrastructure corridors

This is why Panvel Navi Mumbai metro real estate is becoming a serious investment category.

What are investors expecting here?

- Higher appreciation over 5–10 years

- Strong demand for mid-income housing

- Rising interest from IT and industrial professionals

This is also connected to upcoming metro projects Mumbai property growth, as the city expands into newer nodes.

How Is Metro Phase 2 Expected to Influence Mumbai’s Next Price Wave?

Mumbai Metro Phase 2 includes multiple corridors that are actively changing the city’s real estate future.

Why is Phase 2 a big deal?

Because it connects multiple suburban belts that were previously dependent on:

- crowded trains

- congested highways

- limited road networks

What is the real estate effect of Phase 2?

The Mumbai metro phase 2 real estate effect is already visible through:

- Increased pre-launch demand in connected suburbs

- Higher project activity by top developers

- Rising redevelopment interest in older societies

This is especially true for western suburbs where metro access is turning localities into new lifestyle hubs.

Which Areas Are Likely to Witness the Highest Appreciation Due to Metro?

Mumbai’s metro expansion is creating “winners” in every zone. But some corridors stand out due to their location advantage and demand cycle.

Top areas likely to see strong metro-based appreciation:

- Andheri East (commercial + airport connectivity)

- BKC (business demand + Line 3 connectivity)

- Chembur (multi-connectivity advantage)

- Dahisar and Borivali (affordability + metro access)

- Ghatkopar (high rental + Line 1 advantage)

- Panvel (future metro + infrastructure boom)

These pockets are becoming key zones for metro corridor real estate appreciation Mumbai.

What Is the Long-Term Metro Impact on Mumbai’s Real Estate Market?

Mumbai metro is not just a transport upgrade. It is reshaping the entire real estate ecosystem.

Long-term metro-driven market shifts:

- Suburbs becoming premium micro-markets

- Higher redevelopment activity near metro corridors

- Growth of mixed-use developments

- Rise in commercial leasing outside South Mumbai

- Better rental yields for metro-adjacent properties

This is why the overall Mumbai metro impact on property prices is not temporary, it is structural and long-term.

What Should Homebuyers and Investors Consider Before Buying Near Metro Corridors?

Buying near metro corridors is smart, but only if done strategically.

Key factors to check before investing:

- Distance from station (walkable zones command higher value)

- Noise levels if property is too close

- Future corridor expansions

- Station footfall impact on privacy

- Developer credibility and project approvals

A well-selected metro-linked property can offer strong capital appreciation and stable rental demand, making it one of the best strategies for metro connectivity real estate investment Mumbai.

Conclusion: Is Mumbai Metro Creating a New Real Estate Pricing Map?

Mumbai Metro is rewriting how people evaluate property locations. Earlier, being close to railway stations was the biggest advantage. Today, being close to a metro station is becoming an equal or even stronger selling point, especially for new-age homebuyers.

The metro is improving connectivity, reducing commute fatigue, boosting rental demand, and attracting new commercial activity. Most importantly, it is making far suburbs more livable and investment-worthy.

This is exactly why metro led demand for properties Mumbai continues to rise, and why metro corridors are becoming the future hotspots of real estate growth.

If you are actively tracking infrastructure-led real estate opportunities, do not miss our detailed blog on Mumbai Metro Line 3, where we break down its stations, key impact zones, and investment potential in depth.

For verified property options, upcoming projects, and direct builder connections, explore Housiey, where you can discover the right home without unnecessary broker interference.