Investing in Indian real estate has always been an attractive option for

Non-Resident Indians (NRIs). With rising property values, strong rental yields, and regulatory reforms like

RERA, the Indian real estate market offers both security and long-term appreciation. However, NRIs face unique tax, legal, and compliance challenges when buying or selling property in India. This comprehensive guide explores everything an NRI needs to know in 2025, including TDS rules, repatriation limits, RERA guidelines, and

taxation benefits.

What is the TDS on property sale by NRI in 2025 (short-term vs long-term)?

When an NRI sells property in India, the buyer must deduct Tax Deducted at Source (TDS) under Section 195.

- Short-Term Capital Gains (STCG): If the property is sold within 24 months of purchase, gains are treated as short-term and taxed at the individual’s income tax slab rates (ranging from 5% to 30% plus surcharge and cess). The buyer deducts TDS accordingly.

- Long-Term Capital Gains (LTCG): If sold after 24 months, LTCG applies at 20% with indexation. However, the Finance Act 2024 introduced a new optional 12.5% LTCG regime without indexation, giving NRIs a choice.

Thus, NRIs must carefully assess whether to opt for the indexed 20% regime or the new 12.5% flat regime in 2025.

How can an NRI get a lower TDS certificate (Form 13) to avoid excess deduction?

Many NRIs suffer higher TDS deductions than their actual tax liability. For example, exemptions under Sections 54, 54EC, or DTAA benefits may reduce their tax. To avoid excess deduction, NRIs can apply to the Assessing Officer or online through TRACES for a Lower/Nil Deduction Certificate under Form 13.

Once issued, the buyer deducts TDS at the reduced rate mentioned in the certificate. This ensures liquidity and avoids waiting for refunds.

What documents are needed for NRI property sale TDS and DTAA benefits (TRC, Form 10F)?

To claim Double Taxation Avoidance Agreement (DTAA) benefits, NRIs must furnish the following documents:

- Tax Residency Certificate (TRC): Issued by the country of residence, proving tax residency status.

- Form 10F: Declaration containing nationality, address, and tax identification number.

- PAN Card: Mandatory for all property transactions in India.

- Sale Agreement and Bank Details: For compliance and remittance purposes.

Submitting these ensures correct tax computation and prevents higher TDS deduction.

How much money can an NRI repatriate after selling property in India (USD 1 million rule)?

The Reserve Bank of India (RBI) allows NRIs to repatriate sale proceeds under FEMA rules, subject to limits. An NRI can remit up to USD 1 million per financial year (including all assets such as property, bank balances, etc.) after paying applicable taxes.

If multiple properties are sold, repatriation must still adhere to this limit. Excess funds can be retained in NRO accounts for use in India.

Also Read:- NRI Home Loans Documents Checklist: Everything You Need to Know

What are the repatriation rules if property was bought from NRE vs NRO funds (and the 2-property limit)?

- Property purchased from NRE/FCNR funds: The sale proceeds can be freely repatriated, subject to RBI rules. However, repatriation is limited to two residential properties.

- Property purchased from NRO funds or inherited: The repatriation cap is USD 1 million per year.

NRIs must keep proper purchase records to establish the funding source, as compliance checks are strict.

Can NRIs repatriate rental income, and what TDS applies on rent paid to NRIs (Section 195, 30%)?

Yes, rental income earned in India can be repatriated after deducting applicable taxes. The tenant paying rent to an NRI must deduct TDS at 30% plus surcharge and cess under Section 195.

NRIs can then remit net rental income abroad, subject to Form 15CA/CB filings and tax compliance.

Which taxes apply on NRI property sale: LTCG 20% with indexation or new 12.5% regime, surcharges, cess?

In 2025, NRIs selling property can choose between:

- 20% LTCG with indexation (plus surcharge and 4% cess).

- 12.5% flat LTCG without indexation, introduced in Budget 2024.

Short-term gains continue to be taxed at slab rates. Additionally, surcharges (10–37%) apply based on income levels. Careful tax planning is needed to minimize outflow.

Also Read:- Income Tax Rules 2025 for NRIs Selling Property in India

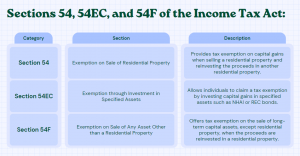

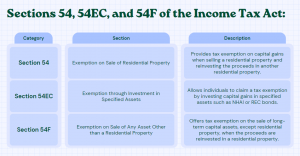

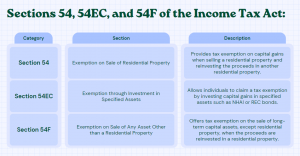

What are the Section 54/54EC/54F options for NRI capital gains exemption?

- Section 54: Reinvestment of LTCG into a new residential property within India within 2 years (purchase) or 3 years (construction).

- Section 54EC: Investment in specified REC/NHAI bonds within 6 months, up to Rs. 50 lakh.

- Section 54F: Available if the entire sale consideration (not just gains) is reinvested in one residential property.

These exemptions significantly reduce tax liability, provided timelines are followed.

How to file Form 15CA/CB for repatriation and obtain tax clearance?

Repatriation requires compliance with income tax clearance norms.

- Form 15CA: Declaration of remittance, filed online.

- Form 15CB: Certification by a Chartered Accountant, confirming that taxes are paid.

Banks do not process repatriation requests without these forms. Hence, timely filing is crucial.

What properties can NRIs buy in India under FEMA (restrictions on agricultural/plantation/farmhouse)?

NRIs are allowed to purchase:

- Residential properties.

- Commercial properties.

They cannot purchase agricultural land, plantation property, or farmhouses. However, such property may be inherited or received as a gift. FEMA strictly regulates these restrictions.

Also Read:- Penalty for Building House on Agricultural Land in Maharashtra

How to verify a project’s RERA registration and buyer rights in 2025 (refunds, interest, defect liability)?

Before investing, NRIs should verify the project’s registration on the respective state’s RERA website. Registered projects offer:

- Refunds with interest if the builder defaults or delays.

- Defect liability of 5 years on construction quality.

- Transparency in approvals, carpet area, and timelines.

This ensures NRIs are safeguarded from fraud or delays.

Also Read:- Common Real Estate fraud and How to Avoid Them

Are real estate agents required to be registered under RERA (RERA 2.0 updates)?

Yes, RERA mandates that all real estate agents must register to operate legally. Under RERA 2.0 (2025 updates), stricter compliance norms apply, including renewal requirements, accountability for false promises, and penalties.

NRIs should transact only with RERA-registered agents to ensure credibility.

Conclusion

Navigating India’s real estate as an NRI requires understanding of TDS rules, repatriation procedures, FEMA restrictions, and RERA safeguards. From tax-saving strategies like exemptions under Sections 54/54EC/54F to compliance with DTAA and RBI limits, every step must be carefully planned. While property investment in India continues to offer lucrative opportunities, being well-informed prevents financial and legal hurdles.

At Housiey, we make the property-buying journey transparent, hassle-free, and builder-direct ensuring you get the right property without middlemen complications.

For a deeper understanding of taxation, don’t miss our detailed blog on “GST on Under Construction Property“.

FAQs

Investing in Indian real estate has always been an attractive option for

Non-Resident Indians (NRIs). With rising property values, strong rental yields, and regulatory reforms like

RERA, the Indian real estate market offers both security and long-term appreciation. However, NRIs face unique tax, legal, and compliance challenges when buying or selling property in India. This comprehensive guide explores everything an NRI needs to know in 2025, including TDS rules, repatriation limits, RERA guidelines, and

taxation benefits.

What is the TDS on property sale by NRI in 2025 (short-term vs long-term)?

When an NRI sells property in India, the buyer must deduct Tax Deducted at Source (TDS) under Section 195.

- Short-Term Capital Gains (STCG): If the property is sold within 24 months of purchase, gains are treated as short-term and taxed at the individual’s income tax slab rates (ranging from 5% to 30% plus surcharge and cess). The buyer deducts TDS accordingly.

- Long-Term Capital Gains (LTCG): If sold after 24 months, LTCG applies at 20% with indexation. However, the Finance Act 2024 introduced a new optional 12.5% LTCG regime without indexation, giving NRIs a choice.

Thus, NRIs must carefully assess whether to opt for the indexed 20% regime or the new 12.5% flat regime in 2025.

How can an NRI get a lower TDS certificate (Form 13) to avoid excess deduction?

Many NRIs suffer higher TDS deductions than their actual tax liability. For example, exemptions under Sections 54, 54EC, or DTAA benefits may reduce their tax. To avoid excess deduction, NRIs can apply to the Assessing Officer or online through TRACES for a Lower/Nil Deduction Certificate under Form 13.

Once issued, the buyer deducts TDS at the reduced rate mentioned in the certificate. This ensures liquidity and avoids waiting for refunds.

What documents are needed for NRI property sale TDS and DTAA benefits (TRC, Form 10F)?

To claim Double Taxation Avoidance Agreement (DTAA) benefits, NRIs must furnish the following documents:

- Tax Residency Certificate (TRC): Issued by the country of residence, proving tax residency status.

- Form 10F: Declaration containing nationality, address, and tax identification number.

- PAN Card: Mandatory for all property transactions in India.

- Sale Agreement and Bank Details: For compliance and remittance purposes.

Submitting these ensures correct tax computation and prevents higher TDS deduction.

How much money can an NRI repatriate after selling property in India (USD 1 million rule)?

The Reserve Bank of India (RBI) allows NRIs to repatriate sale proceeds under FEMA rules, subject to limits. An NRI can remit up to USD 1 million per financial year (including all assets such as property, bank balances, etc.) after paying applicable taxes.

If multiple properties are sold, repatriation must still adhere to this limit. Excess funds can be retained in NRO accounts for use in India.

Also Read:- NRI Home Loans Documents Checklist: Everything You Need to Know

What are the repatriation rules if property was bought from NRE vs NRO funds (and the 2-property limit)?

- Property purchased from NRE/FCNR funds: The sale proceeds can be freely repatriated, subject to RBI rules. However, repatriation is limited to two residential properties.

- Property purchased from NRO funds or inherited: The repatriation cap is USD 1 million per year.

NRIs must keep proper purchase records to establish the funding source, as compliance checks are strict.

Can NRIs repatriate rental income, and what TDS applies on rent paid to NRIs (Section 195, 30%)?

Yes, rental income earned in India can be repatriated after deducting applicable taxes. The tenant paying rent to an NRI must deduct TDS at 30% plus surcharge and cess under Section 195.

NRIs can then remit net rental income abroad, subject to Form 15CA/CB filings and tax compliance.

Which taxes apply on NRI property sale: LTCG 20% with indexation or new 12.5% regime, surcharges, cess?

In 2025, NRIs selling property can choose between:

- 20% LTCG with indexation (plus surcharge and 4% cess).

- 12.5% flat LTCG without indexation, introduced in Budget 2024.

Short-term gains continue to be taxed at slab rates. Additionally, surcharges (10–37%) apply based on income levels. Careful tax planning is needed to minimize outflow.

Also Read:- Income Tax Rules 2025 for NRIs Selling Property in India

What are the Section 54/54EC/54F options for NRI capital gains exemption?

- Section 54: Reinvestment of LTCG into a new residential property within India within 2 years (purchase) or 3 years (construction).

- Section 54EC: Investment in specified REC/NHAI bonds within 6 months, up to Rs. 50 lakh.

- Section 54F: Available if the entire sale consideration (not just gains) is reinvested in one residential property.

These exemptions significantly reduce tax liability, provided timelines are followed.

How to file Form 15CA/CB for repatriation and obtain tax clearance?

Repatriation requires compliance with income tax clearance norms.

- Form 15CA: Declaration of remittance, filed online.

- Form 15CB: Certification by a Chartered Accountant, confirming that taxes are paid.

Banks do not process repatriation requests without these forms. Hence, timely filing is crucial.

What properties can NRIs buy in India under FEMA (restrictions on agricultural/plantation/farmhouse)?

NRIs are allowed to purchase:

- Residential properties.

- Commercial properties.

They cannot purchase agricultural land, plantation property, or farmhouses. However, such property may be inherited or received as a gift. FEMA strictly regulates these restrictions.

Also Read:- Penalty for Building House on Agricultural Land in Maharashtra

How to verify a project’s RERA registration and buyer rights in 2025 (refunds, interest, defect liability)?

Before investing, NRIs should verify the project’s registration on the respective state’s RERA website. Registered projects offer:

- Refunds with interest if the builder defaults or delays.

- Defect liability of 5 years on construction quality.

- Transparency in approvals, carpet area, and timelines.

This ensures NRIs are safeguarded from fraud or delays.

Also Read:- Common Real Estate fraud and How to Avoid Them

Are real estate agents required to be registered under RERA (RERA 2.0 updates)?

Yes, RERA mandates that all real estate agents must register to operate legally. Under RERA 2.0 (2025 updates), stricter compliance norms apply, including renewal requirements, accountability for false promises, and penalties.

NRIs should transact only with RERA-registered agents to ensure credibility.

Conclusion

Navigating India’s real estate as an NRI requires understanding of TDS rules, repatriation procedures, FEMA restrictions, and RERA safeguards. From tax-saving strategies like exemptions under Sections 54/54EC/54F to compliance with DTAA and RBI limits, every step must be carefully planned. While property investment in India continues to offer lucrative opportunities, being well-informed prevents financial and legal hurdles.

At Housiey, we make the property-buying journey transparent, hassle-free, and builder-direct ensuring you get the right property without middlemen complications.

For a deeper understanding of taxation, don’t miss our detailed blog on “GST on Under Construction Property“.

FAQs